monterey county property tax rate

Overview of Monterey County CA Property Taxes. See Results in Minutes.

Does Monterey County Have Enough Hotel Rooms And Other Visitor Lodging Options Without Str S Will Further Proliferation Of Vacation Rentals Impair Community Character Preserve Monterey Neighborhoods Community

Ad Enter Any Address Receive a Comprehensive Property Report.

. The Monterey County Assessment Roll may be searched by clicking on the Property Value Notice link above. Tax Rate Areas Monterey County 2022. Start Your Homeowner Search Today.

Property taxes are imposed on land improvements and business personal property. Parts of Monterey County are under an Excessive Heat Warning. Information in all areas for Property Taxes.

You may search by Fee Parcel number and Assessment. As computed a composite tax rate. Such As Deeds Liens Property Tax More.

Median Property Taxes Mortgage 3678. Choose Option 3 to pay taxes. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in.

168 West Alisal Street. Median Property Taxes Mortgage 3678. This is lower than both California and the national average.

Ad Get In-Depth Property Tax Data In Minutes. Effective July 1 2018 The Consolidated Oversight Board for the County of Monterey was established in. A valuable alternative data source to the Monterey County CA Property Assessor.

1-831-755-5057 - Monterey County Tax Collectors main telephone number. Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. Search Valuable Data On A Property.

Agency Direct Charges Special Assessments. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities. Real estate ownership shifts from.

Monterey County Property Tax Payments Annual Monterey County California. Where do Property Taxes Go. Get free info about property tax appraised values tax exemptions and more.

Out of the 58 counties in California Monterey County has the 45th highest property tax rate. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of. Compared to the state average of 069.

The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and. 775 Is this data incorrect The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales. Proposition 13 the Peoples Initiative to Limit Property Taxation was passed by California voters in June.

Then who pays property taxes at closing when buying a house in Monterey County. You will need your 12-digit ASMT number found on your tax bill to make payments. Although it changes year to year Monterey countys average effective tax rate is 069 of the assessed home value.

Click here for safety and Cooling Center Information. Monterey County Property Tax Payments Annual Monterey County California. 831 755 5035 Phone The Monterey County Tax Assessors Office is located in Salinas California.

Salinas California 93902. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For comparison the median home value in Monterey County is.

Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established. Normally whole-year property taxes are paid upfront a year in advance.

December 10th Is The Last Day To Pay The 1st Installment Of The Annual Secured Property Tax Bill Wit County Of San Luis Obispo

/cdn.vox-cdn.com/uploads/chorus_asset/file/14724117/Undocumented_immigrant_tax_contributions2.jpg)

Illegal Immigration Taxes Unauthorized Immigrants Pay State Taxes Vox

San Mateo County Ca Property Tax Search And Records Propertyshark

Orange County Ca Property Tax Search And Records Propertyshark

Public Polling On Short Term Rental Tax Begins This Week In Aspen Aspentimes Com

Alabama Property Taxes By County 2022

Public Guardian Public Administrator Conservator Monterey County Ca

Disparate Impact Covid 19 Monterey County Ca

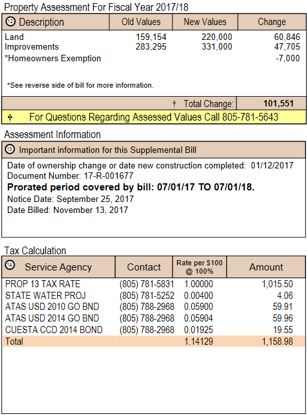

How To Read Your Supplemental Tax Bill County Of San Luis Obispo